1. COVID’s impact is here to stay

With employees working remotely throughout the COVID era, factory leaders realized quickly that workers could get sick through interactions with others. However, they found out that robots didn’t get sick. Between social distancing and working from home, it had manufacturing facilities rethinking compliance and safety requirements.

Some of the negative impacts came upon us quickly during COVID

- Lack of safety stock – People didn’t have safety stock to sit back on with international disruptions in transportation due to COVID & a shift in heavier demand for cars

- Supply chain disruption – It also disrupted the supply chain, requiring companies to become more self-reliant in building out their own componentry

However, we saw some positive shifts too

- The business case for transformation – In the past, it was difficult to create the business case for digital transformation in factories such as artificial intelligence (AI) or robotics. The year of COVID was enough of a business case and accelerated the overall focus from leadership teams

- Cobots are being adopted quickly with humans working alongside them as a stepping stone to automation

“Businesses are looking and seeing that humans can get sick from COVID. Machines can’t.”

Marcus D. Casey, Associate Professor of Economics at the University of Illinois at Chicago put it well, when he said, “Businesses are looking and seeing that humans can get sick from COVID. Machines can’t. Even if we don’t see it right away, we surely see that there’s going to be a move toward more automation.”

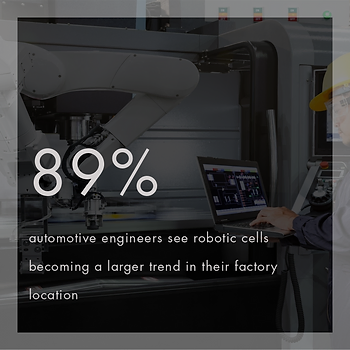

Poll

In fact, 89% of automotive engineers see robotic cells becoming a larger trend in their factory location (poll, AUTOMOTIVE: Innovation, electrification & the shifting factory floor print, Valence Industrial, 3/24/21).

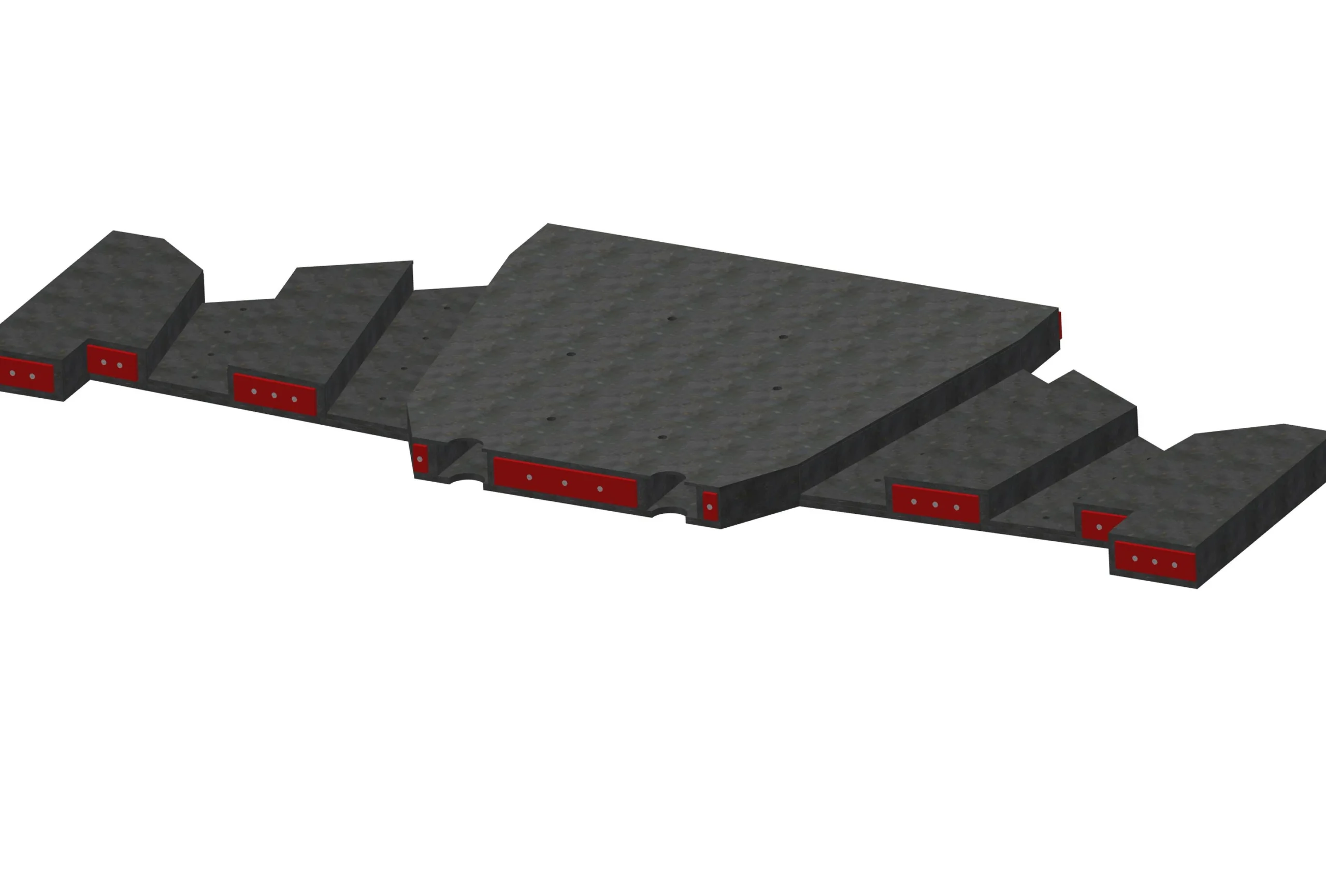

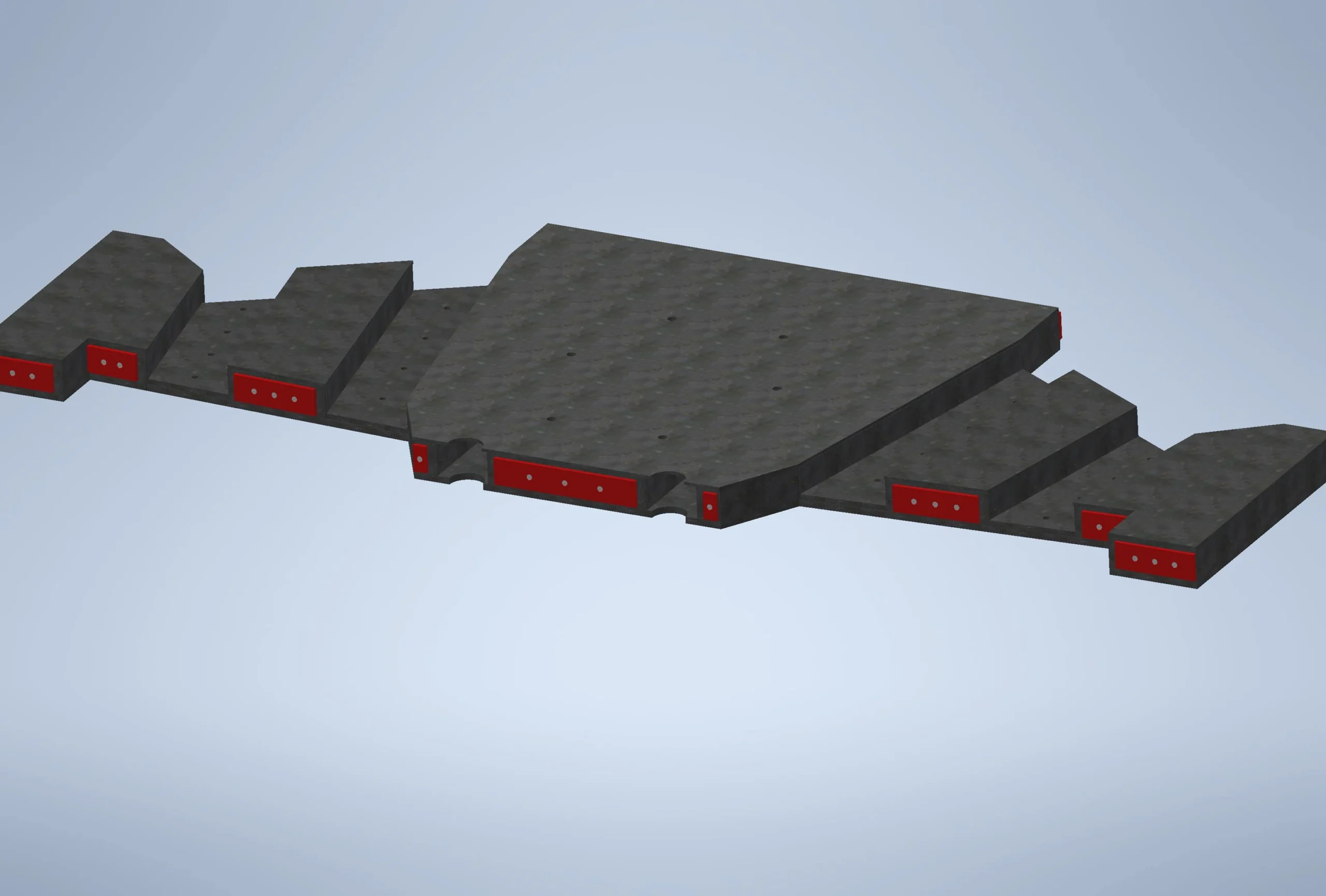

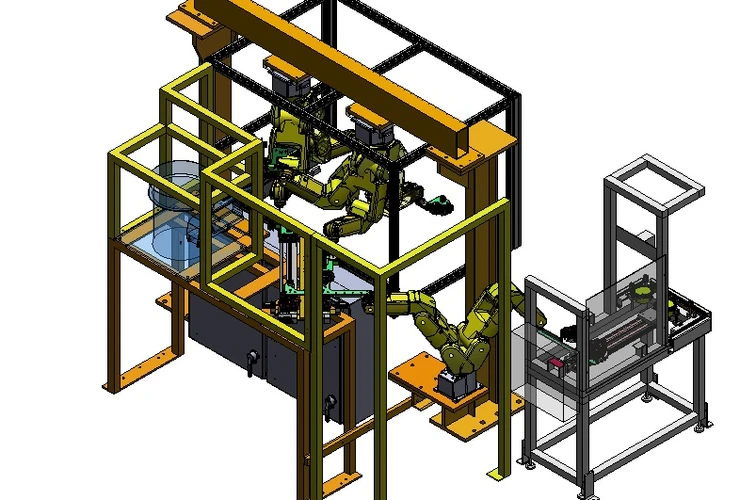

Case study

Valence has seen a heavier focus on cobots, or collaborative robots, in factories. A customer recently requested a robotic support frame and safety fence for a cobot. Read more about the case study.

2. Smart Factories have brought about the fourth industrial revolution

The landscape is changing whether you are Toyota, GM, Ford, and so on. These companies have been doing automation implementations for years. They’ve been using big data, AI and machine to machine learning to increase quality, reduce scrap and increase throughput.

Recently, with manufacturers having workforce shortages and a need to meet increased demands, industry 4.0 has taken automated cells and made them smarter.

Taking it to the next level

Instead of a SME watching to ensure a robot doesn’t damage tooling–with industry 4.0 — that person will be monitoring five to seven of these cells instead of one.

This person is an expert.

However, one of the big challenges is that these people who have been able to shift into these roles are late career and will be retiring soon. New individuals coming into manufacturing roles haven’t been trained on the ins and outs of machines to be as effective.

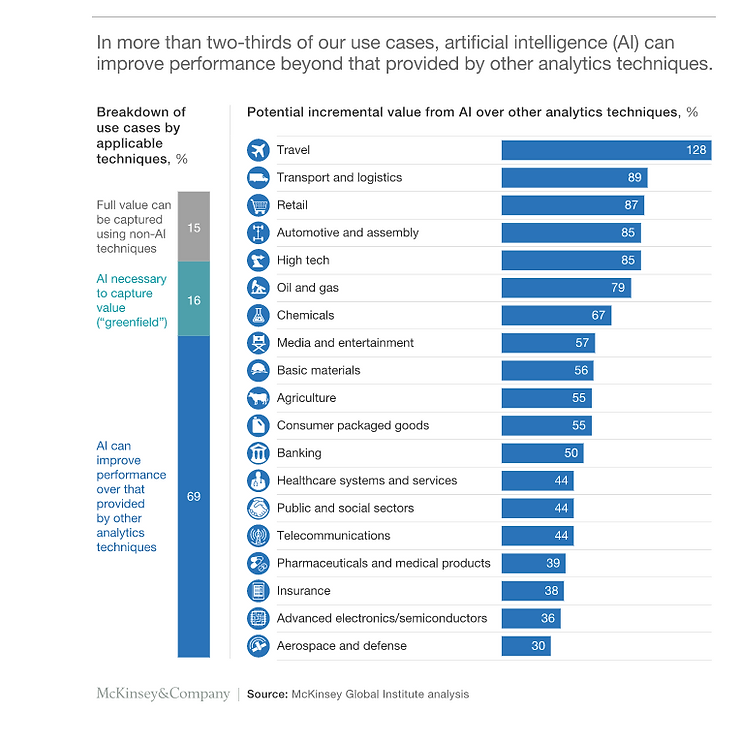

2/3 of use cases show AI can improve performance beyond other analytics techniques

McKinsey collated and analyzed more than 400 use cases across 19 industries and nine business functions. In 2/3 of them, AI could improve performance beyond other techniques.

The vast number of industries could be significantly improved through AI, taking that cell and making it smart so it can make its own adjustments. For example, the computer can decide whether tooling needs to be released rather than an operator deciding it.

With the shifts from individual-to-machines to cobots, or even machine-to-machine activities, that means the factory floor print is shifting faster than it ever has historically. Companies are realizing they need to move fast as they aren’t fully gaining on efficiencies.

“Only 13% of businesses have realized the full impact of their digital investments, enabling them to achieve cost savings and create growth. The optimal mix of technologies could save large companies up to $16 billion” according to Accenture.

Poll

70% of automotive engineers see their factory having an increased number of platform changes compared to past years (poll, AUTOMOTIVE: Innovation, electrification & the shifting factory floor print, Valence Industrial, 3/24/21).

Case study

Valence is seeing the need for more flexibility with changing floor prints of factories. In a recent case, a Valence customer requested 14 different modularized carts that could all fit within one cart. This reduced forklift traffic flow by 60%. Read the full case study.

3. Electrification is already here

Pre-COVID, there was already a lot of disruption around the development of electric cars, driverless cars, automated factories and ride-sharing. With all of these trends, companies have been slowing down traditional combustion engine factories. However, the mood has shifted on electric vehicles.

“Automakers in the United States, China, Europe and South Korea are already sprinting past their Japanese competitors. Toyota did not release its first all-electric vehicle on the consumer market until early 2020, and then only in China. Honda is relying on GM to produce electric vehicles for the U.S. market…In fact, Tesla is more valuable than the next six automakers combined, despite having only a tiny fraction of their sales,” according to the Baltimore Sun.

Significant increase in the number of platform launches over the next few years

In 2032 Hybrid and EVs will make up 53% of all car sales, according to LMC Automotive. And with electric cars making up less than 3% of global sales today, there will have to be a shift in electric vehicle creation in factories to make up for the change in demand.

“The automotive industry has been investing in AI for years. Tier ones are well positioned. Tiers one are very committed to automation, already taking as much human interactions out of the process as possible. At EWI, we only get involved at OEMs when they don’t have the time to get it launched, or in some cases, they don’t have expertise that we do. But otherwise, they usually have much larger staff sizes,” according to Doug Myers, Head of R&D Automotive Sales at EWI.

Automotive strategies to prepare to shift into EV

- Build – Rivian created its own capability starting from scratch like Canoo, Karma and Tesla

- Buy – Ford bought Rivian to get into electric. American Axle bought EDrive to get in the market

- Ally – GM developed an alliance with Honda and Nikola Motor. Fiat bought Peugeot

The industry has woken up over the last year and a half. They realized electric vehicles weren’t five or 10 years away. It is upon us. Internal combustion vehicles went down.

No one backed off. Everyone went all in during COVID.

GM, example of going all in

GM made two distinct moves recently, announcing it is teaming up with Honda to make cars that they’ll both be able to sell. Also, it is teaming up with the startup, Nikola Motor, to build an electric pickup truck. The alliance allows Nikola Motor to build a vehicle using GM’s factory.

- $27B commitment to EVs and AVs through 2025

- 30 EVs launched by 2025

- >50% of product development devoted to EV & AVs

“Moving from internal combustion and powertrain systems compared to a two-thousand pound electric motor tray, you don’t just plug it in the same way. It changes the dynamic, and changes the floor print,” according to Myers.

Poll

63% of automotive engineers commonly prototype prior to ordering runs from contractors (poll, AUTOMOTIVE: Innovation, electrification & the shifting factory floor print, Valence Industrial, 3/24/21).

Case Study

With this move, more customers are considering prototyping. Among Valence’s customers, 60% of customers choose to prototype with projects over $50k. Because of the reduction of mis-measured or incorrectly developed components, projects are, on average, 2 weeks faster when prototyping.

Complex projects are defined as having moving parts, tight tolerances, needing an understanding of how it will withstand daily manufacturing rigors.

Read a case study of Valence prototyping a pallet, and another one of just refurbishing to reduce cost. As engineers shift to completely new types of equipment, it’ll be important to consider whether it is more cost effective to prototype or refurbish/rework existing material handling processes.